BYJU’s , the edtech behemoth from India expected to go public in the next few months with a market capitalisation of nearly $16.8B, has gone to great lengths to acquire edtech firms this year. The Bengaluru-based edtech decacorn has aggressively invested in 9 firm acquisitions to build a dominant market.

$100M acquisition Austrian math edtech

Byju’s has now announced its tenth acquisition in 2021, acquiring GeoGebra, an Austrian-based learning platform. GeoGebra is an interactive mathematics study platform with over 100M students in 195 countries.

The purchase price was not disclosed, but a source familiar with the issue told Techcrunch that the deal was around $100M and included both cash and shares. There has been no official comment from Byju’s yet.

GeoGebra’s current apps and web services will remain free following the acquisition, according to Byju’s.

Tynker, Scholr, Aakash Institute, Hashlearn, Epic, Great Learning, and Gradeup, among others, were purchased by the Bangalore-based startup for over $2 billion in cash and equity agreements this year.

In the remote learning era, India’s edtech sector has seen tremendous growth. According to statistics, the industry has made over $4B in the last five years and is predicted to grow from $700M to $30B in the next 10 years.

This acquisition strengthens Byju’s entire product strategy, bringing GeoGebra’s expertise to bear on developing new product offers and learning formats for its existing mathematics portfolio. It advances Byju’s goal of making math more engaging, resulting in improved learning outcomes.This collaboration of two like-minded firms will provide all students with complete, personalised, and immersive learning experiences, the company said in a statement.

“At Byju’s, we’ve been making math enjoyable, visual, and engaging with the help of innovative teaching and technology.” “With GeoGebra on board, we will continue to improve, reinvent, and transform the way Math is taught and learnt,” said Anita Kishore, the company’s chief strategy officer.

“It (GeoGebra) is designed to promote mathematical knowledge and has key features that provide interactive resources that adjust to each child’s learning style and speed,” she further added.

“GeoGebra was created out of a desire to assist pupils learn math in a fun and aesthetically appealing way. BYJU’S shares our enthusiasm for learning and teaching, making them an ideal partner for our future endeavours. In a statement, Markus Hohenwarter, co-founder of GeoGebra, said, “I am certain that this relationship will assist millions of children study mathematics in an engaging way, allowing them to overcome their fear of math and learn to master it.”

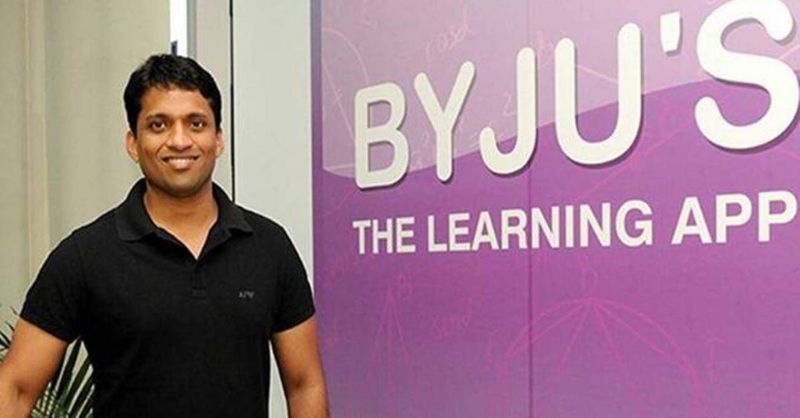

Byju’s startup story

Byju’s had raised $1.5B in June, valued at $16.5B, from UBS Group, Abu Dhabi sovereign fund ADQ, and Blackstone Group, among others. Byju’s had previously raised over $1B in April from investors including Baron Funds, Facebook co-founder Eduardo Saverin’s B Capital Group, and XN Exponent Holding, a US-based investment hedge fund. The corporation was valued at roughly $15B at the time of the fundraising.

Byju Raveendran and Divya Gokulnath founded the company in 2011 to provide online video-based learning programmes for the K-12 segment and competitive exams. Byju was an engineer who began tutoring children in mathematics in 2006.

Byju’s: The Learning App was released in August 2015. They launched Byju’s Math App for Kids and Byju’s Parent Connect app in 2017. It had 1.5 crores (15 million) members and 900,000 paid users by 2018. Byju’s obtained the sponsorship rights for the Indian cricket team shirt in July 2019, replacing its previous sponsor Oppo.

Byju’s bought test prep provider Aakash Educational Services Ltd. in an estimated $950M cash and equity deal in April 2021. As part of the arrangement, Aakash’s founders and Blackstone Group obtained minority holdings in Byju’s.

Fundings and financials

Aarin Capital started funding Byju’s in 2013. Byju’s had received nearly $785M in funding from investors such as Sequoia Capital India, the Chan Zuckerberg Initiative (CZI), Tencent, Sofina, Lightspeed Venture Partners, Brussels-based family office Verlinvest, development finance institution IFC, Napsters Ventures, CPPIB, and General Atlantic as of 2019.

Byju’s was the first Asian startup to get funding from the Chan-Zuckerberg Initiative (co-funded by Facebook founder Mark Zuckerberg and Priscilla Chan). Byju’s gained decacorn status in June 2020 as a result of an investment by Mary Meeker’s Bond Capital.

Byju’s raised $200M in a new investment round headed by BlackRock and T. Rowe Price in November 2020, valuing the company at $12B. Byju’s raised $460M in a series F investment round this year, and B Capital, Baron Funds, and XN invested $1B in the company in April 2021.