Decentralised Finance, or DeFi, is set to be the next stage of the cryptocurrency revolution, bringing the range of services that people can access purely through crypto close to that of banks.

Traditional, or fiat, currency relies on the trust that people have in institutions. Ultimately, this is because they have faith in central banks, like the Bank of England or the Federal Reserve, to ensure the value of their currency. Cryptocurrency replaces this by using a blockchain as a ledger. However, it could not replace the other functions banks and others offered, like lending or trading.

DeFi makes that possible. By using smart contracts, essentially lines in the Blockchain, it allows actions like loans or trades to take place. Mostly based on the Ethereum blockchain and using the ERC20 protocol, these smart contracts don’t just act as a ledger, but will contain triggers, such as repayments. It means that a trustless platform can replace the costly middleman of a bank, helping to democratise the financial sector.

Europe, and especially the United Kingdom, has long been a pioneer and innovator in the financial sector. Neo-banks like Revolut and Wise have been making it easy for people to open multi-currency accounts in seconds and never even need a physical card, and, unsurprisingly, Europe is emerging as a DeFi centre.

Here are nine European startups that are leading the way in DeFi.

Radix

Founder/s: Dan Hughes

Founded year: 2016

Total funding: NA

With investment from LocalGlobe and Wise’s Taavet Hinrikus, Radix raised over £9 million from their first public token sale.

Radix is not just a decentralised network, it offers developers a scripting language — Scrypto — that empowers them to build their own apps on top. By addressing both speed and security, Radix is helping DeFi grow by making it easy to build the next crypto app.

Sender

Founder/s: Kenny Qi

Founded year: 2022

Total funding: NA

Sender raised over $4.5 million last year, helping to fuel its rapid growth.

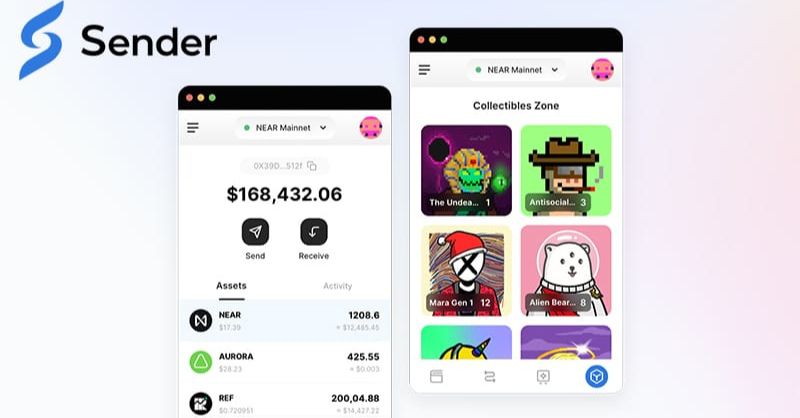

With their app- or web-based wallet, Sender allows users to easily move between different cryptocurrencies, and even between crypto and fiat currencies. It is beginning to develop trading tools, so users can participate in cryptomarkets with just a few taps.

Argent

Founder/s: Gerald Goldstein, Itamar Lesuisse, Julien Niset

Founded year: 2017

Total funding: NA

London-based Argent completed a $40 million Series B round in 2022. The Ethereum-based wallet is one of the most popular, with over 500,000 users.

The startup is developing its app to be a one-stop utility for everything Ethereum related. Users will not just be able to deal in cryptocurrency and NFTs, but participate in decentralised autonomous organisations (DAOs), virtual real estate and even web3 gaming.

Tesseract

Founder/s: Yichen Wu

Founded year: 2017

Total funding: NA

Tesseract became one of Finland’s largest startups when they secured a $25 million Series A investment in 2021.

The company offers a white-label solution, creating an easy way for businesses to integrate crypto with their offer. The increasing interest in crypto from institutional investment has seen Tesseract maintain rapid growth since their 2017 launch.

Credix

Founder/s: Thomas Bohner, Maxim Piessen, Chaim Finizola

Founded year: 2021

Total funding: NA

With total funding of $13.8 million in just over a year, Credix is building a DeFi platform that connects lenders with borrowers.

With a focus on emerging markets, their platform allows institutional investors easy access to credit opportunities. Meanwhile, those looking for credit can get access to finance, often at lower rates than offered by traditional banks.

SingularityNET

Founder/s: Ben Goertzel, Cassio Pennachin, Simone Giacomelli, Simone Giacomelli

Founded year: 2017

Total funding: NA

Founded by Ben Goertzel, an AI-researcher, SingularityNET is the perhaps inevitable combination of AI and crypto.

The startup wants to wrest control of AI away from large corporate owners, so is leveraging blockchain to democratise it. The Amsterdam-based startup allows anyone to buy or sell AI at scale. The founder hopes that, over time, it will result in the AI collectively learning in a way that furthers humanity, not just profits.

Unstoppable

Founder/s: Peter Grosskopf, Maximilian von Wallenberg-Pachaly, Omid Aladini

Founded year: 2017

Total funding: NA

Berlin-based Unstoppable’s product is the Ultimate.app, which they launched after closing a €12.5 million Series A round.

The mobile app offers users easy access to a curated set of DeFi protocols. By being multichain and non-custodial, it is making crypto fully accessible to anyone.

3Commas

Founder/s: Yuriy Sorokin, Egor Razumovskii, Mikhail Goryunov

Founded year: 2017

Total funding: NA

Estonian 3Commas saw further expansion in 2022 with a $37 million Series B funding round. However, the year was not entirely smooth for them, and ended with a data breach that saw a significant part of their API database leaked.

The platform gives users the power to trade both manually and by using automated strategies. The company claims that, by being able to immediately take advantage of changes in prices, 70% of their users profit each month.

Grizzly

Founder/s: Leon Helg, Andrés Soltermann

Founded year: 2021

Total funding: NA

Taking its name from a bear market, Grizzly secured $26 million to help make DeFi accessible to those that do not want, or cannot afford, the risk that crypto can bring.

Users on the platform can profit in the usual way from crypto. However, instead of relying purely on that profit, some is then used to fund other trades, a process known as liquidity mining. It means that whether it’s a bull or a bear market, users can have confidence their crypto is working for them.