Cryptocurrencies are being embraced by both private users and businesses alike. Cryptocurrencies have the potential to be faster, easier, and more secure than traditional currencies, but as with all new digital assets, hackers and scammers are never far behind. Along with security concerns, refining their use takes time and it is often an ongoing process to make any tech user-friendly. The technology can at times be complex and difficult to navigate which can make some businesses hesitant to adopt crypto fully.

Currently, a battle is being fought to create a crypto platform that can offer an all-in-one solution that is secure, easy to use, cost effective and has all the required services in one place. French fintech startup Fipto is one such service that aims to make its platform the go-to for all businesses and corporations who use both crypto and fiat currencies.

Seed funding

Fipto has successfully secured €15 million in seed funding. Led by Serena Capital, and Motier Ventures, the funding comes at a time when tech investment has become sparse.

The funding will allow Fipto to further develop its platform, offering an all-in-one payments and treasury solution that enables businesses to convert and send any currency by harnessing the advantages of blockchain: speed, cost efficiency, and transparency.

Fipto’s vision and platform

At the heart of Fipto’s platform lies a dedication to harnessing the potential of blockchain technology. Their comprehensive platform serves as an all-in-one payments and treasury solution, empowering businesses to seamlessly convert and transmit any currency, be it fiat or digital, while capitalising on blockchain’s unique advantages.

Instant cross-border payments

One of the standout features of Fipto’s platform is its capability to facilitate instant cross-border payments. The service operates 24/7 365 days a year. In doing so, Fipto eliminates the need for intermediary banks and significantly slashes transaction costs, presenting an attractive benefit to businesses engaged in international commerce.

Security and regulatory compliance

Security and regulatory compliance are paramount for businesses. Fipto’s platform boasts institutional-grade custody and wallet security with multi-party computation (MPC) wallets, providing businesses with peace of mind and privacy in the digital realm. Notably, Fipto has secured registration as a Digital Asset Service Provider (DASP) with the esteemed French Financial Markets Authority (AMF), ensuring adherence to regulatory standards.

Cash management governance and transparency

Fipto’s platform streamlines cash management governance, offering businesses tools for seamless user and payment workflow management. Features like user permissions, multi-signature capabilities, two-factor authentication, and beneficiary whitelisting enhance user control. Moreover, Fipto promotes transparency with built-in processes for Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) compliance.

Addressing blockchain challenges

Fipto recognises the challenges businesses face when adopting blockchain technology, including complexity, regulatory concerns, the need for comprehensive services, and confidentiality. Fipto says its platform addresses each of these hurdles efficiently while ensuring conformity to best practice policies.

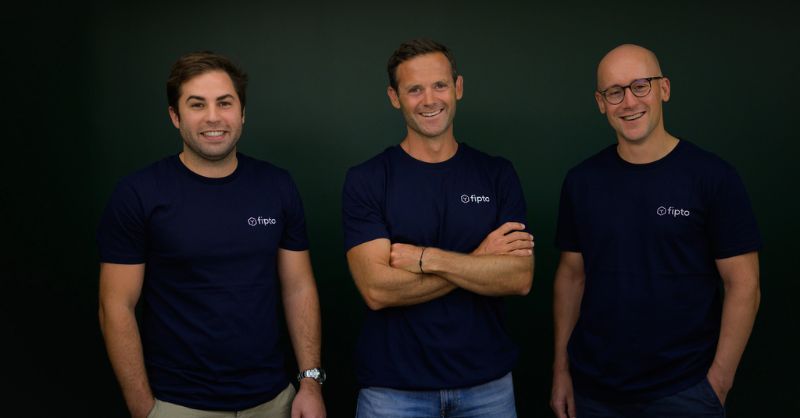

Meet the founders

Fipto was co-founded by three individuals with backgrounds in M&A advisory, fintech, and payments. Patrick Mollard, co-founder and CEO, whose extensive experience includes leadership roles in the fintech industry, Gregoire Andrieu, co-founder and CRO, who spearheaded European operations at Groupon before delving into fintech, and Bertrand Godin, co-founder and COO, an expert in payments, compliance, and cryptocurrencies.

Gregoire and Patrick met in 2007 when they worked together at ABN AMRO. They met Bertrand while working at the same Fintech company and quickly formed a strong connection. The three founders shared the same values that they were eager to bring to their new project, Fipto.

Competition and the Fipto team

Although Fipto’s rivals are currently few, they are dedicated to advancing and refining their product. The company’s team comprises nearly thirty full-time employees, with two thirds of them focussing on product development and research. Ethnically and gender diverse, the company prioritises respect, fairness, efficiency, and prioritizing teamwork as their core values.